CRE Growth: More Defense of Credit Processes

By: David Ruffin, Principal of IntelliCredit, a division of QwickRate

At Bank Director’s 2021 Acquire or Be Acquired Conference, investment bankers propounded a persistent theme to their commercial banking counterparts: Get your loan growth up, it’s at the heart of your bank’s valuation and pricing modeling.

Organic loan growth at community banks had been sluggish for a couple of years, excluding the impact of the historic pandemic stimulus programs. This growth rebounded in 2021 and 2022, but it was almost entirely driven by a familiar source: commercial real estate, or CRE. Since the 1990s, various market dynamics and talent considerations have led community bankers to increasingly favor CRE as their loan product of choice.

While the growth problem seemed resolved, complications arose. Smaller banks emerged as the sole segment, banking or nonbanking, of the U.S. economy driving CRE growth. By June 2023, the four federal regulators issued joint enhanced management guidance in response to what they perceived as a growing systemic credit risk for the industry.

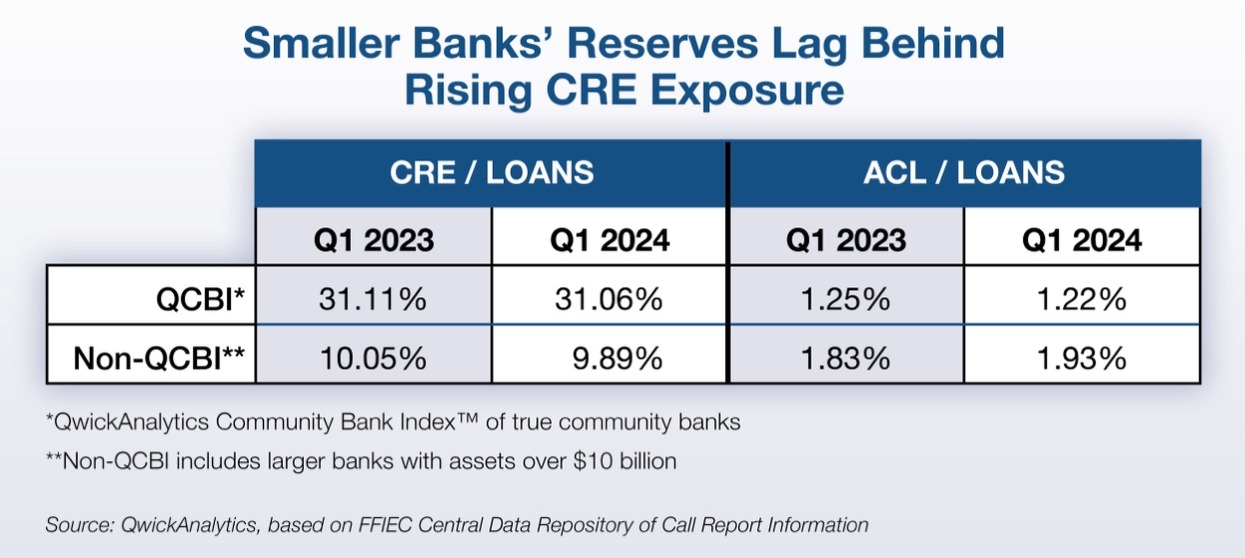

Likewise, in the post-COVID era, the allowance for credit losses, or ACL, has followed different trajectories for large and small banks. As shown in the chart above, larger banks, while reducing their CRE exposure, have increased reserves. In contrast, the growth-to-reserve ratio at smaller banks has remained flat or inverse.

While credit quality metrics generally remain healthy, challenges are clearly increasing. They’re exacerbated by inflation, rising interest rates and pandemic-induced paradigm shifts, such as reduced office space usage and the impact of decreased business travel on the hospitality industry.

There is no longer doubt that regulatory scrutiny on safety and soundness is increasing, particularly for community banks with strong CRE dependence. Regulatory orders to management and boards are on the rise, with a common focus on credit processes rather than transactional credit deterioration.

So, what should community banks do if they are becoming a larger target for regulatory scrutiny? Improve their credit processes, especially the awareness and oversight of the CRE loan portfolio.

For all banks, and particularly those continuing to grow their CRE portfolios, consider the following strategies:

- Deepen CRE concentration assessments. Don’t focus solely on the broader 100/300 percentages of risk-based capital guidance. Instead, emphasize and analyze the various CRE loan product subsets that comprise concentrations.

- Recognize that the risk is more dimensional. Understand that risk encompasses more than just the borrower’s traditional repayment capacity. It also includes the econometric and supply-and-demand profile of a bank’s CRE lending footprints.

- Supplement the bank’s CRE lending defense strategy with objective third-party data. Use reputable sources, such as the Atlanta Federal Reserve’s CRE Market Index and subscription-based services like Vertical IQ for diverse industry and regional metrics.

- Improve macro portfolio data analytics. Smaller banks often lack the ability to analyze, or slice-and-dice, their loan portfolios with the diagnostic precision of larger institutions. A bank’s loan portfolio is its DNA; banks need to embrace data analytics capabilities to better understand their unique characteristics.

- Embrace multiple stress test modes. Recognize the benefits of both top-down (portfolio level) and bottom-up (loan level) approaches. Consider companion stress tests alongside loan review engagements to extrapolate CRE subset impacts on allocated risk-based capital in real time.

- Expand loan review. Remember that loan review is a critical line of defense in reducing uncertainty and identifying emerging hotspots of credit problems.

- Update loan policies and servicing protocols to reflect the current environment. For instance, outdated policies such as allowing three years of interest-only payments for new CRE projects, a policy established five years ago, may be untenable in 2024.

- Integrate enhanced CRE oversight with strategic and capital plans, and risk appetite statements. Most importantly, enrich communications with, and participation by, bank boards. Efforts to improve CRE risk management often go unrecognized if they’re not documented in board minutes.

In summary, using the more familiar lending landscape of CRE to bolster loan growth, smaller banks have assumed the added obligations of defending and analyzing their reliance on a segment that is now widely perceived by stakeholders as being fraught with growing risk. Particularly in this environment, a bank needs to write its own credit risk script before a regulator does it for them.

David Ruffin is Principal of IntelliCredit, a division of QwickRate. He has extensive experience in the financial industry including a long and pronounced emphasis on credit risk in a variety of roles that range from bank lender and senior credit officer to the co-founder of IntelliCredit and its technology that is revolutionizing a decades-old loan review process. For more information, visit intellicredit.com or email info@intellicredit.com.